By Anthony Diosdi

Recently, the Internal Revenue Service (“IRS”) and the Treasury Department issued final regulations regarding the reporting requirements for domestic disregarded entities held by a nonresident. According to the regulations under Internal Revenue Code Section 6038A, a disregarded entity will be treated as a U.S. corporation. Historically, a foreign-owned disregarded entity was just that- disregarded. As a result, nonresidents were not required to disclose disregarded entities to the IRS on a tax return or informational return. Under the new rules, this is no longer the case.

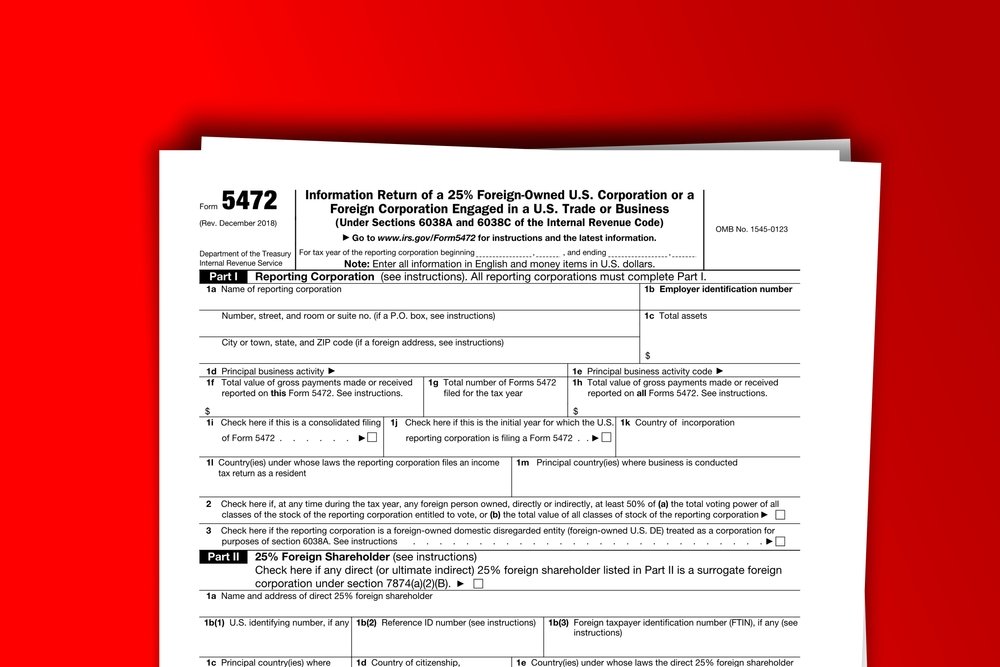

Under the new regulations, a disregarded entity held by a nonresident individual or foreign entity is required to obtain a Employer Identification Number (“EIN”), prepare a pro-forma Form 1120, and file a Form 5472, Information Return of a 25% Foreign Owned US Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business. The information that is required on a Form 5472 is as follows:

1. The name and address of the reporting corporation and its EIN.

2. Identification of the foreign stockholder of the reporting corporation, including the country of organization, the country where it conducts business and files tax returns.

3. Identification of the related party with which the reporting corporation is conducting reportable transactions, including its name and address, principal business activity, the country in which it conducts business, and the country in which it files tax returns.

4. Information about certain monetary transactions between the reporting corporation and the related party, listed dollar amounts involved in all sales of inventory or tangible property; payments of rents, royalties, license fees or other payments for intangible property rights; payments for services or commissions; borrowing and interest payments; and premiums.

5. Information about non-monetary transactions between the reporting corporation and the related party, describing the substance and the size of the transaction or group of transactions, with an estimate of the fair market value, or nature or importance of any non-monetary value transferred.

6. Specific questions regarding the value of imported goods that may differ from tax and customs.

In addition to filing Form 5472, a nonresident or foreign entity that holds an interest in a disregarded entity must maintain permanent books and records sufficient to establish the correctness of the Form 5472.

Penalty for Noncompliance

The penalty for failure to timely file Form 5472 or to maintain proper records is $25,000. If such failure continues for more than 90 days after notification by the IRS, the IRS may assess an additional penalty of $25,000 for each 30-day period or fraction thereof. There is also the possibility of criminal penalties under Internal Revenue Code Sections 7203, 7206, and 7207 for failure to submit information or for filing false or fraudulent information.

Filing Requirements

Nonresidents and foreign entities that hold interests in disregarded entities must file a Form 5472 with the IRS. The Form 5472 must be submitted with a corporate tax return. There is also a need to maintain appropriate records. Treasury Regulation Section 1.6038A-3 provides that:

“Such records must be permanent, accurate, and complete, and must clearly establish income, deductions, and credits. This requirement includes records of the reporting corporation itself, as well as records of any foreign related party that may be relevant to determine the correct U.S. tax treatment of transactions between the reporting corporation and foreign related parties. The relevance of such records with respect to related party transactions shall be determined upon the basis of all the facts and circumstances.”

Conclusion

It is extremely important to work with an international tax specialist to ensure accurate preparation of your Form 5472 and the attached pro forma Form 1120. Having the wrong professional complete your Form 5472 can result in significant penalties. The Internal Revenue Code authorizes the IRS to impose a $20,000 penalty for failure to file substantially complete and accurate Form 5472 returns on time. An additional $25,000 continuation penalty may be assessed for each 30 day period of noncompliance. In addition, the IRS can assess a 40 percent accuracy penalty on incorrectly reported income.

Anthony Diosdi is one of several tax attorneys and international tax attorneys at Diosdi Ching & Liu, LLP. Anthony focuses his practice on domestic and international tax planning for multinational companies, closely held businesses, and individuals. Anthony has written numerous articles on international tax planning and frequently provides continuing educational programs to other tax professionals.

He has assisted companies with a number of international tax issues, including Subpart F, GILTI, and FDII planning, foreign tax credit planning, and tax-efficient cash repatriation strategies. Anthony also regularly advises foreign individuals on tax efficient mechanisms for doing business in the United States, investing in U.S. real estate, and pre-immigration planning. Anthony is a member of the California and Florida bars. He can be reached at 415-318-3990 or adiosdi@sftaxcounsel.com.

This article is not legal or tax advice. If you are in need of legal or tax advice, you should immediately consult a licensed attorney.