This article provides an overview of the rules governing outbound forward triangular mergers. This article uses a hypothetical Singapore corporation which acquires a U.S. corporation to discuss the issues commonly faced by tax professionals in outbound forward triangular merger. A forward triangular reorganization occurs when an acquiror uses the shares of its parent as merger consideration when the target merges into the acquiror, resulting in the acquiror receiving substantially all of the target’s assets.

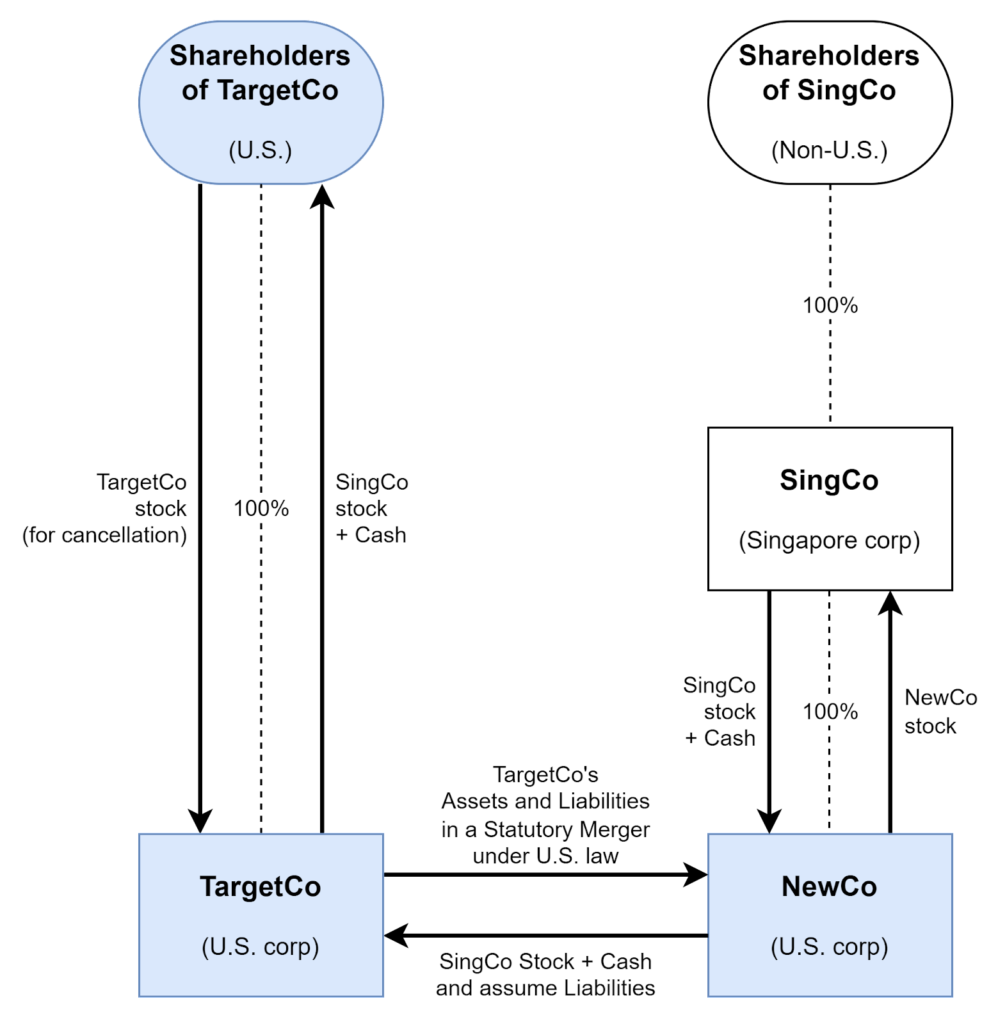

Let’s assume that a Singaporean corporation (“SingCo”) is entering into a forward triangular merger and for that it is setting up a new Delaware entity as NewCo with the purpose of acquiring business of the target corporation as TargetCo. The consideration is in the form of shares (50 percent) and the balance will be paid in cash.

Below, please see Illustration 1, which outlines the transaction.

Overview of the U.S. Tax Law Governing Outbound Forward Triangular Reorganizations

If a U.S. corporation is liquidated and its assets are distributed to foreign shareholders, U.S. tax will be imposed on the gain realized by the distributing corporation, except to the extent that a tax free-free-exchange provision provides otherwise. If the stock or assets of a U.S. corporation are acquired by a foreign corporation in exchange for stock of the foreign corporation, except to the extent that the gain is sheltered by a tax-free-exchange provision. Section 367 of the Internal Revenue Code requires a U.S. person transferring appreciated property to a foreign corporation to recognize a gain on the transfer. This result is achieved by denying corporate status to the foreign corporation, in which case the general rules for taxable exchanges apply.

The Internal Revenue Code provides for nonrecognition of gain or loss realized in connection with a considerable number of corporate organizational changes. These include acquisitive and other reorganizations defined in Section 368(a)(1) and divisive reorganizations under Section 355. Reorganizations, as defined in Section 368(a)(1), include statutory mergers and consolidations, acquisitions by one corporation of the stock or assets of another corporation, recapitalizations, and changes in form or place of organization.

The purpose of the reorganization provisions is to permit on a tax-free basis “such readjustments of corporate structures made in one of the particular ways specified in the [Internal Revenue] Code, as are required by business exigencies and which effect only a readjustment of continuing interest in property under modified corporate forms.” See Treas. Reg. Section 1.368-1(b). There are three general requirements for a transaction to qualify as a tax-free reorganization:

1 The transaction must have a business purpose.

2 The original owners must retain a continued proprietary interest in the reorganized corporation (the “continuity of interest” requirement). See Treas. Reg. Section 1.368-1(e). The Treasury Regulations consider the continuity of interest requirement satisfied if, following the transaction, historic shareholders of the target corporation hold stock of the acquiring corporation (as a result of prior ownership of target stock) representing 40% of the value of the stock of the target corporation. See Treas. Reg. Section 1.368-1(e)(2)(v), Ex. 1.

3 In an acquisitive reorganization, the acquiring corporation must either continue the acquired corporation’s historic business or use a significant portion of the acquired corporation’s historic business assets in a business (the “continuity of business enterprise” requirement). See Treas. Reg. Section 1.368-1(d). Under this rule, the acquirer must either continue the target’s historical business or use a significant portion of the target’s assets in an existing business for 2 years after the transaction.

The basic types of acquisitive reorganizations are:

1. A statutory Type A reorganization where one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in a merger or consolidation effected under U.S. (or non-U.S.) law;

2. A Type B reorganization where the acquiring corporation exchanges its shares for the shares of the target corporation; and

3. A Type C reorganization where the acquiring corporation exchanges its shares for the assets of the target corporation.

A transaction that fails to qualify as one of the above discussed acquisitive reorganizations generally results in a taxable transaction.

Even if a transaction qualifies as a Type A, B, or C reorganization under Section 368(a)(1), any gains realized on the transaction may still be recognized (and thus taxable) under Section 367(a)(1) if a U.S. person transfers property to a foreign corporation. In the case of outbound transfers of shares in a U.S. corporation (the U.S. target company), the regulations provide for a limited-interest exception. This limited-interest exception generally provides for the nonrecognition of gain on the transfer of U.S. shares by a U.S. person to the transferee foreign corporation if all of the following tests are satisfied:

1. The U.S. person owns less than 5 percent (by both vote and value) of the stock of the transferee foreign corporation immediately after the transfer. Otherwise, the U.S. person must enter into a five-year gain recognition agreement with the Internal Revenue Service (“IRS”).

2. Fifty percent or less (by both vote and value) of the stock of the transferee foreign corporation is received, in the aggregate, by U.S. persons in the transaction.

3 Immediately after the transfer, fifty percent or less (by both vote and value) of the stock of the transferee foreign corporation is owned, in the aggregate, by U.S. persons who (i) are officers or directors of the U.S. target company or (ii) owned 5 percent or more (by vote and value) of the stock of the U.S. target company immediately before the transfer.

4. Satisfaction of the active trade or business test, which requires that (i) for the 36-month period immediately before the transfer, the transferee foreign corporation was engaged in an active trade or business outside the United States, (ii) at the time of the transfer, neither the U.S. persons nor the transferee foreign corporation intend to substantially dispose of, or discontinue, such trade or business, and (iii) at the time of the transfer, the value of the transferee foreign corporation is at least equal to the value of the U.S. target company. An active trade or business generally does not include the making or managing of investments for the account of the transferee foreign corporation.

See Treas. Reg. Section 1.367(a)-3(c)(1).

In the context of international corporate acquisitions, tax-free statutory mergers often take the form of forward triangular mergers or reorganizations, in which the acquiror uses the shares of its parent as the target merges into the acquiror, resulting in the acquiror receiving substantially all of the target’s assets. In order to qualify as a forward triangular merger, the transaction must qualify as a Type A reorganization.

Does the Consideration of 50 Percent and the Balance in Cash Qualify for a Forward Triangular Reorganization?

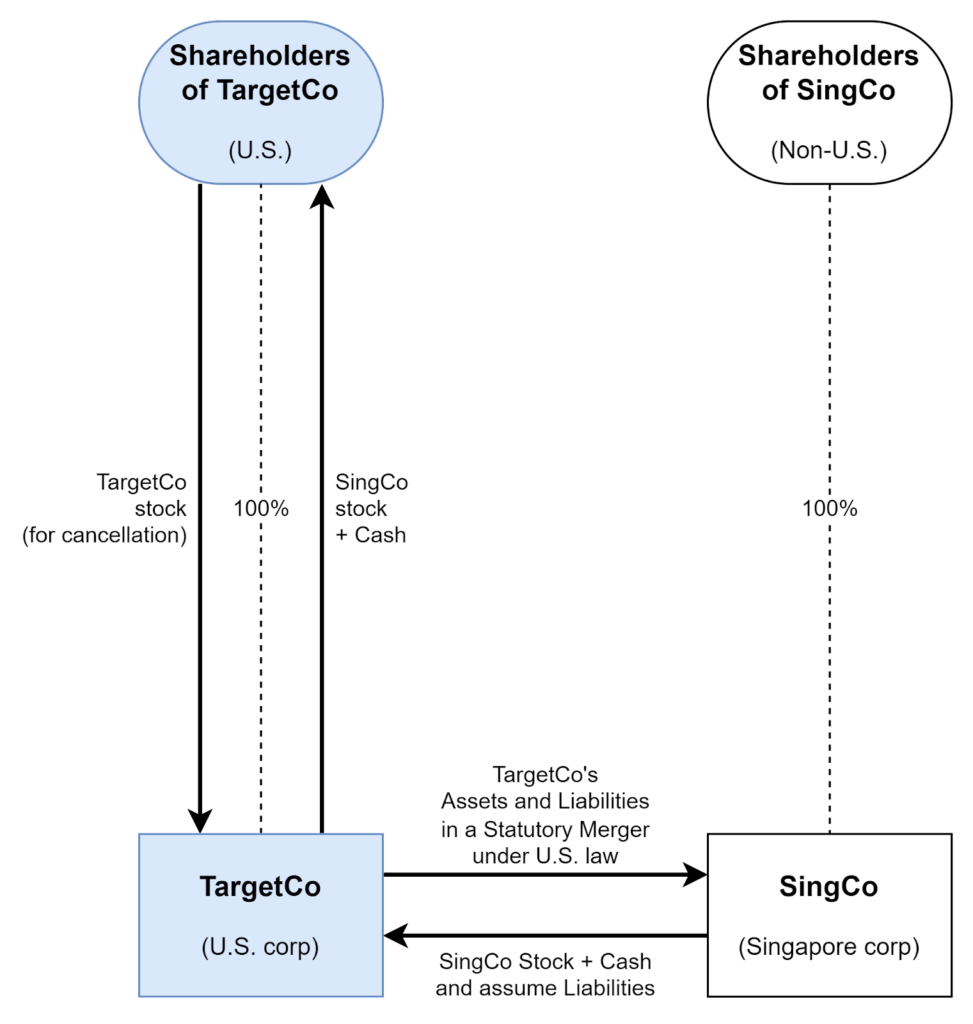

As provided in regulations to Internal Revenue Code Section 368(a)(2)(D), one of the requirements for a forward triangular merger is that the merger must be able to qualify as a Type A reorganization if the target corporation (TargetCo) were to merge directly into the controlling corporation (SingCo) instead of the acquiring corporation (NewCo). Below, as discussed in Illustration 2, is how a hypothetical Type A reorganization would be:

As a general matter, the “continuity of interest” requirement for a forward triangular Type A reorganization would be satisfied if at least 40% of the total consideration received consists of SingCo stock (though courts have allowed lower percentages). However, the non-stock consideration received by TargetCo’s shareholders would be treated as “boot” (non-like-kind property in an exchange and subject to tax) under Internal Revenue Code Section 356(a).

Does Treasury Regulation Section 1.367(a)-3(d) Treat the Transaction as an Indirect Stock Transfer?

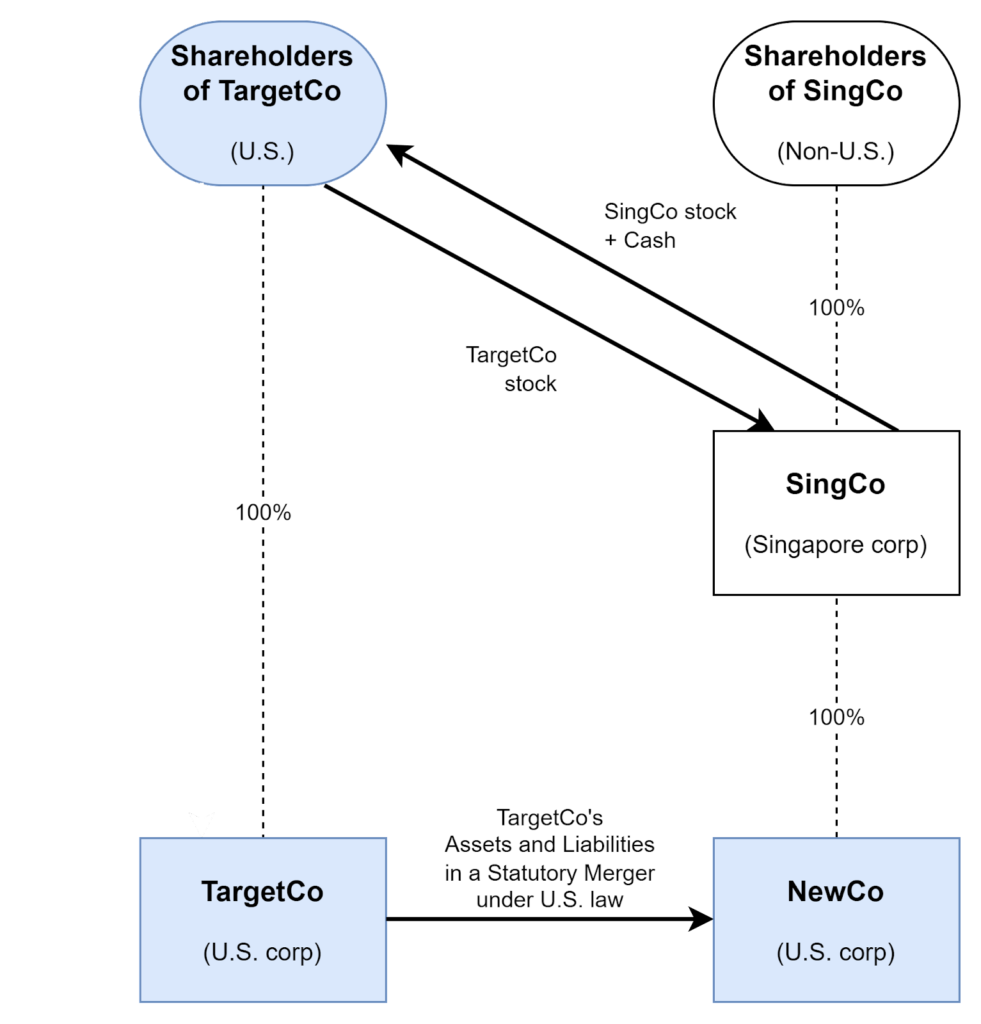

It is likely that paragraph (d) of Treasury Regulation Section 1.367(a)-3 would treat the transaction as an “indirect stock transfer” falling under paragraph (d)(1)(i), with facts similar to those in Example 1 of paragraph (d)(3) (where both the acquired and acquiring corporations are domestic). Accordingly, the transaction reformulated as an indirect transfer would be as follows:

In Example 1, the acquiring corporation “NewCo” (i.e., NewCo in the instant transaction) is a wholly-owned U.S. subsidiary of the foreign transferee corporation “F” (i.e., SingCo), and the acquired corporation “W” (i.e., TargetCo) is a wholly-owned U.S. subsidiary of a single U.S. corporate shareholder “A” (i.e., the shareholders of TargetCo). It should be noted that Example 1 includes the following additional facts:

1. Before the transaction, A and W filed a consolidated federal income tax return, and A did not own any stock in F (applying the attribution rules of Section 318, as modified by Section 958(b)).

2. In the transaction, A receives 40% of the stock of F — i.e., A does not receive more than 50% (by vote or value) of the stock of F.

If Example 1 applies, then the requirements of paragraph (c)(1) discussed above must be complied with in order to avoid gain recognition under Section 367(a)(1).

What are the Gain Recognition Agreements That May Need to be Executed by U.S. Transferees of TargetCo Stock?

Indirect stock transfers falling under paragraph (d)(1)(i) require the execution of five-year gain recognition agreements (as described in Treasury Regulation Section 1.367(a)-8) provided that, among other requirements, TargetCo shareholders who are U.S. persons do not receive in the aggregate more than 50% (by vote or value) of the stock of SingCo. See Treas. Reg. Section 1.367(a)-3(c)(1). A gain recognition agreement is an agreement with the IRS that would need to be signed by each TargetCo shareholder who is a U.S. person owning 5% or more (by vote and value) of the stock of SingCo. The terms of the agreement generally provide that if a triggering event (that is not otherwise excepted) occurs at any time during the gain recognition agreement term (“GRA term”), the U.S. transferor must include in income the gain that was realized but not recognized due to the gain recognition agreement. “GRA term” is defined as the period beginning on the date of the initial transfer and ending as of the close of the fifth full taxable year (not less than 60 months) following the close of the taxable year in which the initial transfer occurs. See Treas. Reg. Section 1.367(a)-8(c)(1)(i). The triggering events are specified in Treasury Regulation Section 1.367(a)-8(j), with the exceptions specified in Treasury Regulation Section 1.367(a)-8(k). Triggering events include, among others:

1. A disposition of substantially all of the assets of the transferred corporation (i.e., NewCo’s assets).

2. A disposition of stock of the transferee foreign corporation (i.e., SingCo stock).

Conclusion

This article is intended to provide the reader with a basic understanding of the issues involved with an outbound forward triangular mergers. It should be evident from this article that this is a relatively complex subject. In addition, it is important to note that this area is constantly subject to new development and changes. As a result, it is crucial that the foreign investor and U.S. target review their particular circumstances with a qualified international tax attorney when planning a cross-border merger or reorganization.

Anthony Diosdi is an international tax attorney at Diosdi & Liu, LLP. Anthony focuses his practice on providing tax planning domestic and international tax planning for multinational companies, closely held businesses, and individuals. In addition to providing tax planning advice, Anthony Diosdi frequently represents taxpayers nationally in controversies before the Internal Revenue Service, United States Tax Court, United States Court of Federal Claims, Federal District Courts, and the Circuit Courts of Appeal. In addition, Anthony Diosdi has written numerous articles on international tax planning and frequently provides continuing educational programs to tax professionals. Anthony Diosdi is a member of the California and Florida bars. He can be reached at 415-318-3990 or adiosdi@sftaxcounsel.com. James Huang can be reached at 415-318-3990 or jhuang@sftaxcounsel.com.

This article is not legal or tax advice. If you are in need of legal or tax advice, you should immediately consult a licensed attorney.