How to Utilize Section 6751 to Successfully Challenge IRS 5472 Penalties

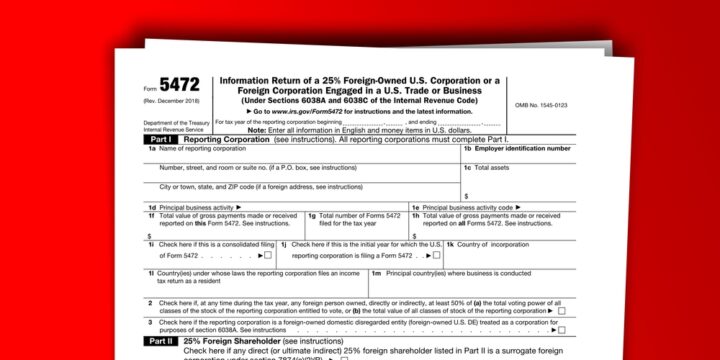

By Anthony Diosdi Under Internal Revenue Code 6038A requires any domestic corporation (including single member LLCs treated as disregarded entities) that is 25 percent foreign-owned to annually file a Form 5472 and a Form 1120 with the Internal Revenue Service (“IRS”). The penalty for failure to file Form 5472 is $25,000. If such failure continues for more than 90 days after notification by the Internal Revenue Service (“IRS”), there is an additional penalty of $25,000 for each 30-day period or fraction. The problem is a significant number of individuals that operate U.S. companies which are 25-percent owned do not know they have a Form 5472 of the reporting obligation. Many of these same individuals believed they could correct the noncompliance by late filing a Form 5472 and Form 1120 with…