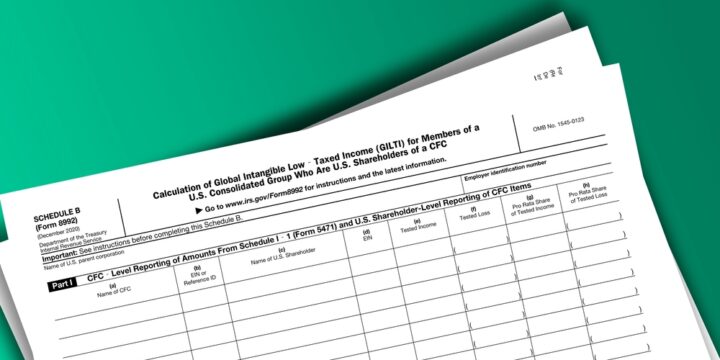

Demystifying the New 2021 IRS Form 5471 Schedule E and Schedule E-1 Used for Reporting and Tracking Foreign Tax Credits

By Anthony Diosdi Schedule E and Schedule E-1 of Form 5471 is used to report taxes paid or accrued by a foreign corporation for which a foreign tax credit is allowed and taxes for which a credit may not be taken. This article will dive into each column and line of the new 2021 Form 5471 Schedule E and Schedule E-1. We will also attempt to provide guidance as to how to prepare this incredibly complicated return. Who Must Complete the Form 5471 Schedule EAnyone preparing a Form 5471 knows that the return consists of many schedules. Schedule E is just one schedule of the Form 5471. Whether or not a taxpayer is required to complete Schedule E depends on what category of filer he or she can be classified…