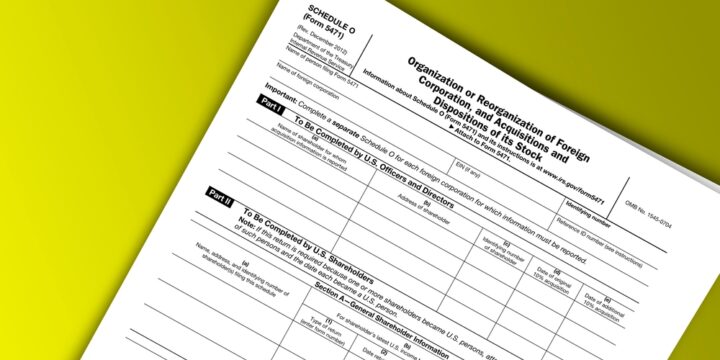

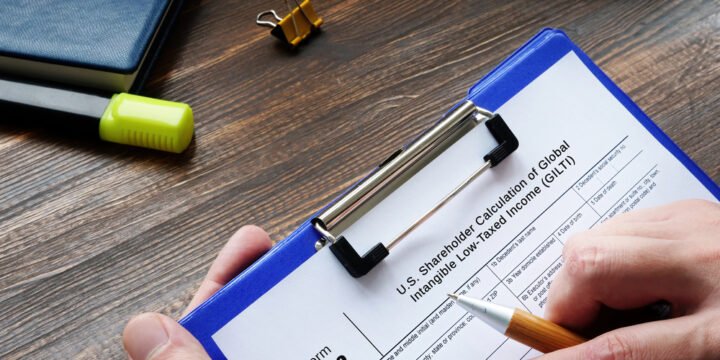

Demystifying the 2021 IRS Form 5471 Schedule Q

By Anthony Diosdi Schedule Q is used to report a controlled foreign corporation’s (“CFC”) income, deductions, and assets by CFC income groups. A CFC shareholder required to complete Schedule Q is required to disclose subpart F income in functional currency by relevant country. In particular, the CFC shareholder must disclose dividends, rents, royalties, net gains from certain property, net gain from commodities, and net currency gains. It will also be necessary to disclose foreign base company sales income, foreign base company services income, insurance income, international boycott income, bribes, kickbacks, and recaptured subpart F income on Schedule Q. Each of these aforementioned items of subpart F income will be required to be categorized into a number of different categories. Schedule Q also requires the CFC shareholder to categorize tested income…